ETH Price Prediction: Bullish Technicals and Strong Fundamentals Suggest Continued Upside

#ETH

- Technical Breakout: ETH testing upper Bollinger Band with MACD confirmation suggests continued upside potential

- Institutional Validation: Market cap surpassing Mastercard demonstrates Ethereum's growing financial significance

- Contrarian Signals: Large whale short positions warrant monitoring despite overwhelmingly bullish sentiment

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge as ETH Tests Key Resistance

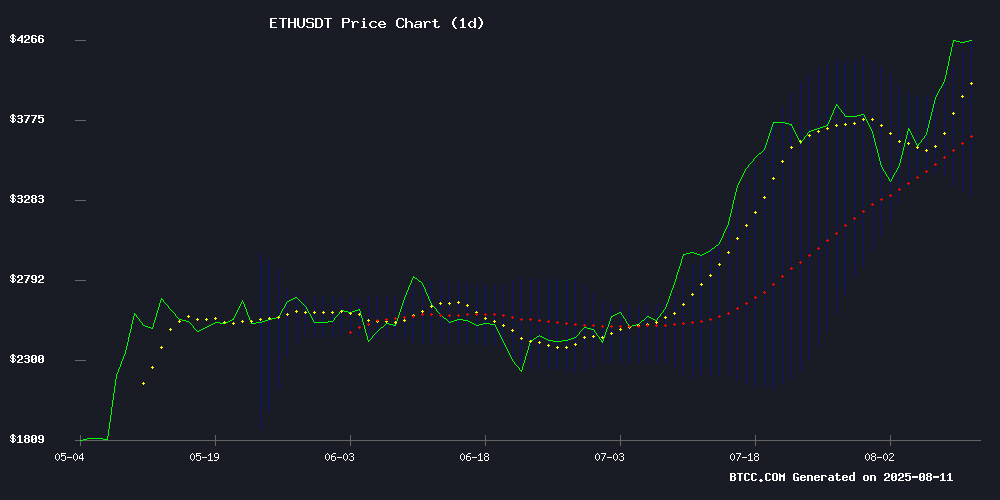

Ethereum (ETH) is currently trading at $4,267.61, showing strong momentum above its 20-day moving average of $3,793.42. The MACD indicator displays a bullish crossover with the histogram turning positive at 40.77, suggesting growing buying pressure. ETH is testing the upper Bollinger Band at $4,275.33, which could act as immediate resistance. According to BTCC financial analyst Mia, 'A sustained break above the $4,275 level WOULD confirm the bullish momentum, potentially targeting the $4,800 psychological resistance in the short term.'

Ethereum Market Sentiment: Institutional Optimism Meets Whale Caution

The market sentiment for ethereum remains overwhelmingly bullish, with multiple headlines highlighting institutional adoption and price milestones. ETH has surpassed Mastercard's market capitalization and is seeing record trading activity in Asian markets. However, BTCC financial analyst Mia notes: 'While AI models predict cycle tops at $15,000 and Vitalik's holdings crossing $1 billion generate positive sentiment, traders should monitor the $84 million short position by whale AguilaTrades as a potential contrarian indicator.' The $5,000 price target for 2025 appears increasingly plausible given current momentum.

Factors Influencing ETH's Price

Ethereum Bulls Charge Toward All-Time High as ETH Surges Past $4,200

Ethereum's resurgence continues unabated, with the cryptocurrency breaking through $4,200 for the first time since December 2021. This bullish momentum positions ETH for a potential assault on its all-time high of $4,862, as market participants demonstrate unwavering conviction.

The weekly chart reveals an uncompromising uptrend since April, punctuated only by brief corrections. August's decisive breach of the psychological $4,000 barrier transformed former resistance into robust support, creating a springboard for further gains.

Technical indicators corroborate the bullish thesis. The weekly MACD maintains its upward trajectory without divergence, while expanding moving averages suggest accelerating momentum. Market structure appears primed for a continuation pattern as ethereum enters what could become a historic price discovery phase.

AI Models Predict Ethereum Cycle Top At $15,000: Analyst

Crypto analyst Miles Deutscher highlighted Ethereum's breakout above the $4,000 zone in an August 10 video, marking a structurally stronger advance toward new all-time highs. A weekly close above this level—unseen since November 2021—signals confirmation for a sustained upward trajectory.

Deutscher's analysis pivots on Ethereum's potential to reach $6,000-$8,000 in price discovery, with a directional benchmark of $7,000. Leveraging large-language models, he quantified probabilistic outcomes for ETH's price by end-2025, suggesting a cycle top of $15,000. The narrative underscores Ethereum's catch-up rally amid broader market highs.

CryptoPunks Dominate NFT Sales with Record $2.56M Transaction

The NFT market surged this week as CryptoPunks claimed all top 10 spots in weekly sales, led by CryptoPunk #1021's 720 ETH ($2.56M) transaction. Phoenix Group data reveals institutional interest is accelerating the sector's growth.

Fidenza #154 secured third place at 90 ETH ($343.98K), while CryptoPunk #9797 took second with 140 ETH ($503.34K). The sales spike coincides with renewed bullish sentiment across digital asset markets.

Ethereum's $5,000 Target in 2025: Grok's Bullish Case

Ethereum's 50% surge in under 30 days has reignited speculation about its price trajectory. Trading firmly above $4,000, the cryptocurrency now faces a critical question: Can it breach $5,000 by 2025? Grok's real-time analysis of crypto sentiment suggests this target is achievable, citing Ethereum's unique positioning for both fundamental and technical growth.

The altcoin's recent performance underscores broader market momentum, with traders increasingly viewing it as a bellwether for the sector. Grok's integration with X allows it to aggregate insights from major crypto voices, identifying trends before they gain mainstream attention. This edge informs its optimistic outlook.

Key drivers include Ethereum's institutional adoption, scalability improvements, and its role as the primary platform for ERC-20 token development. The analysis highlights how these factors could converge to propel prices higher, though market volatility remains an ever-present caveat.

Ethereum Developer Detained in Turkey Over Alleged Blockchain Misuse

An Ethereum developer operating under the pseudonym 'Fede’s Intern' has been detained in Izmir, Turkey, facing accusations of facilitating blockchain misuse. The developer denies the charges, asserting his role as an infrastructure builder within the open-source ecosystem.

Turkish authorities have suggested potential criminal proceedings, prompting outcry from crypto advocates demanding due process. The developer claims international business ties across Europe, the US, and Asia, and has mobilized contacts to contest what he calls baseless allegations.

The case highlights growing tensions between decentralized technology and regulatory frameworks, with Ethereum's infrastructure under scrutiny. 'Everything we do is in the open,' the developer stated, emphasizing transparency in his work.

Vitalik Buterin's Ethereum Holdings Surpass $1 Billion Amid Supply Squeeze

Ethereum co-founder Vitalik Buterin now holds over $1 billion in ETH, according to on-chain data tracked by Arkham Intelligence. His publicly documented addresses contain more than 240,000 ETH, with blockchain explorers providing full transparency of validator activities and transactions.

The revelation comes as institutional players face a tightening OTC market. Galaxy Digital's desk received $160 million worth of ETH from major exchanges in a single hour, while market Maker Wintermute reportedly exhausted its OTC supply. "The only way to buy ETH now is through public markets," observed one commentator, highlighting growing scarcity concerns.

Whale movements suggest intensifying competition for remaining liquidity. Binance, Coinbase and Bitstamp facilitated large transfers to institutional buyers, including an $18.99 million transaction of 4,500 ETH. Market participants speculate whether shrinking supply could accelerate ETH's price trajectory.

Ethereum Surpasses Mastercard in Market Value, Eyes New Price Targets

Ethereum has achieved a significant milestone by overtaking Mastercard in market capitalization, now ranking as the 22nd most valuable asset globally. The cryptocurrency's recent surge past $4,000 has fueled optimism, with Polymarket data suggesting a 57% chance of a new all-time high before October.

Institutional interest in Ethereum is intensifying, with firms like Bitmine and SharpLink accumulating substantial holdings. Bitmine alone now holds over $3.33 billion worth of ETH, positioning itself as the largest institutional holder. This accumulation coincides with broader market anticipation following the passage of the Genius Act.

Ethereum Price Eyeing A Breakout? On-Chain Analysis Places Short-Term Target At $4,800

Ethereum has surged past $4,200, marking its highest level since 2021, with a 25% weekly gain. Analysts now debate whether the rally can sustain momentum to challenge all-time highs.

Technical indicators suggest ETH is testing a critical resistance zone between $4,000-$4,400. A confirmed breakout could pave the way for a retest of record prices, with CryptoQuant analysts identifying $4,800 as the next target.

The MACD indicator's bullish crossover adds credence to upward potential, though historical selling pressure at current levels remains a concern. Market watchers are scrutinizing on-chain data for signs of profit-taking that could stall the advance.

Ethereum Surpasses $4.3K, Flips Mastercard’s Market Cap – Further Breakout Likely?

Ethereum has surged past the $4,300 mark, now boasting a market capitalization of nearly $520 billion—eclipsing payments giant Mastercard. The asset ranks as the 22nd largest globally by market cap, trading at $4,312 at press time. Its 24-hour rally of 1.45% extends a broader upward trajectory, with traders eyeing a 96% probability of hitting $4,400 and a 76% chance of surpassing its all-time high of $4,878 by year-end.

Technical analysts point to a Wyckoff Accumulation pattern breakout, suggesting the current rally may be the precursor to a more sustained uptrend. Lord Hawkins, a noted analyst, identifies the MOVE as a "Sign of Strength" resistance breakout, with a potential markup phase targeting $6,000. Institutional interest and surging trading volumes underscore growing confidence in Ethereum’s momentum.

Mysterious Whale AguilaTrades Bets $84M Against Ethereum Rally

AguilaTrades, the enigmatic crypto whale known for high-stakes market moves, has resurfaced with a bold $84 million short position on Ethereum. The trader Leveraged 25x to bet against ETH as it surged past $4,300, despite the altcoin showing 22% weekly gains amid bullish Layer-2 adoption and altseason speculation.

The contrarian play comes as Ethereum's daily RSI flirts with overbought territory. Market participants are divided—some see this as a prescient hedge against correction, others as a dangerously timed gamble. With such extreme leverage, the position could liquidate rapidly if ETH's rally continues.

Ethereum Hits All-Time Highs in Japan and Korea Amid Local Currency Surges

Ethereum reached record prices in Japanese yen and South Korean won on August 10, outpacing its dollar-denominated performance. The cryptocurrency briefly touched ¥639,455 in Japan, surpassing its previous high of ¥632,954 set in December 2024. In South Korea, ETH hit ₩5,971,000 on Upbit, eclipsing the December 2021 peak of ₩5.9 million.

Despite trading 12% below its November 2021 dollar ATH of $4,891, Ethereum's local currency valuations signal robust regional demand. The yen and won have both appreciated against the dollar this year, making the price surges particularly notable. Investors relying solely on USD charts risk missing these critical market movements.

Exchange rate effects appear negligible—the won strengthened from ₩1,476.23 to ₩1,388.77 per dollar year-to-date, while the yen advanced from ¥157.33 to ¥147.65. The divergence highlights how local liquidity and adoption dynamics can drive cryptocurrency valuations independently of global benchmarks.

Is ETH a good investment?

Based on current technical indicators and market sentiment, Ethereum presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price | $4,267.61 | Testing all-time highs |

| 20-day MA | $3,793.42 | Strong support level |

| MACD | Bullish crossover | Positive momentum |

| Bollinger Bands | Testing upper band | Potential breakout |

BTCC analyst Mia concludes: 'ETH shows strong technical foundations with 1) institutional adoption surpassing traditional finance players, 2) developer activity continuing despite regulatory challenges, and 3) clear technical targets at $4,800 then $5,000. The risk/reward ratio appears favorable for investors with medium-term horizons.'